Online working machinery grows with the growth of technology. Business growing widely with a single motto, “customers are always right”. But the speedy and challenging growth of scammers let you think, that even the person you are dealing with is actually your customer or not? The question raised “Why Businesses Need Identity Proofing” needs a solution and here we elaborating on this.

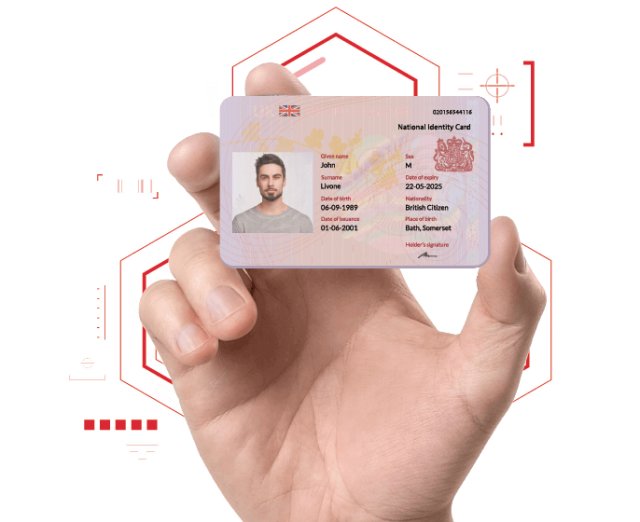

Current wave in cyber-space that leaves the questions all over, identity proofing is the bonafide answer. Identity proofing is a useful tool to identify and scrutinised the forged identity with real-world identities. This can be performed by digital KYC, it takes information by the authentic documents provided by clients, biometrics details, biographic information, and related information.

How Does It work?

With the development of the tech industry, the screening process becomes more vital and vigilant. By the emergence of the biometric sensor, OCR technology, and high-resolution cameras it becomes easier for businesses to adopt digital authentication and identity verification.

KYC solution needs the following documents and details for identity proofing.

- Full legal name

- Social security number

- Residential address

- Date of birth

- Personal phone number

The documents used by identity proofing should not be older than three months.

Reasons illustrating the need for identity proofing by businesses:

To enhance operational efficiency:

The more you reduce the gaps and the circle for margin of doubts and chances of confusion, the more reliable service you ensure. Same is the case with identity proofing service, So what can produce a margin of doubt a customer or your own employ, may write wrong spelling or the spelling of his name that is not matched with the speeling in his national identity card or government-issued documents. In such a case, the identity of the person can be confused with anyone else or may seem like a whole different person.

To reduce the chances of such gaps which can be advantageous for the scammer to fill easily, can be catered by automated data captured through government-issued documents, driving license, passports, utility bills, and credit and debit cards. This process helps in eliminating manual errors in processing, produces results in real-time.

Ensures security protocol against sophisticated attack:

Recent surveys have identifies how identity theft becomes an increasingly wide threat for customers as well as business enterprises. So how to bottle up this genie to ensure smooth functioning of security protocol?

Most businesses by acknowledging the need for KYC solution streams their customers and other business network identities. This can provide them shelter from fraud clients and scammers to add in their physical businesses. And in identifying their potential customers who actually worth their time and service.

To boost up customers confidence in your services:

By alleviating the efforts one needs to fill the pile of papers for providing the required information and replacing it with a single click or a swipe. It helps in reducing the doubts and acquiring the customers’ support and confidence in your service and enhancing the system efficiency level accordingly.

Deter fraud:

The cost of fraud is staggering. 2% of global revenue which is 1.7 trillion dollars, generating through counterfeiting goods. Identity proofing not only verifies the identity but checks the payment method if it is valid or not. This can reduce the chances of making a transaction from stolen or lost credit cards. On the other hand, it minimizes the false claims of chargebacks that cut into your bottom line.

Also Read – How Trade Shows can give a great start to your business?